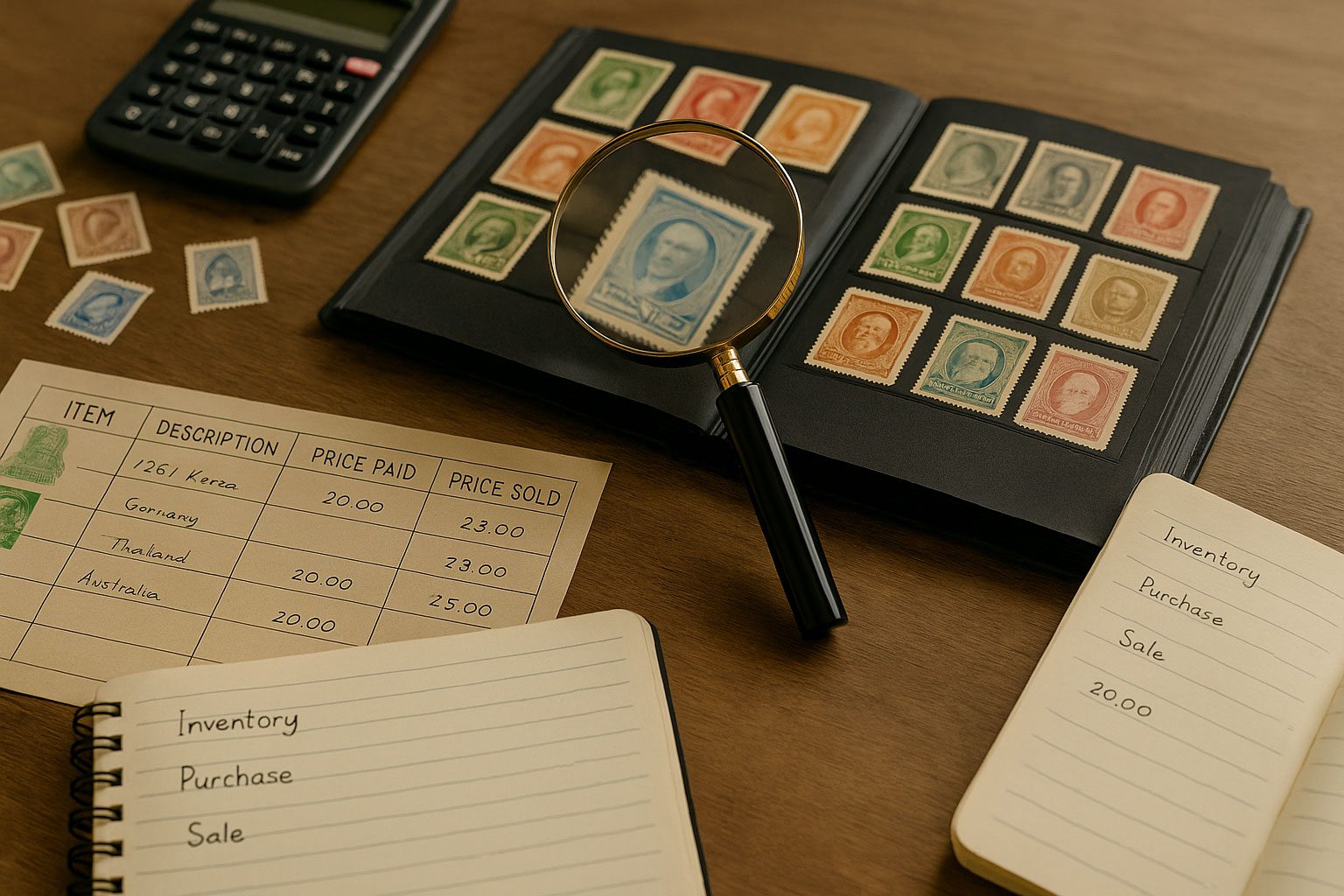

For stamp collectors, a well-curated collection is more than a hobby—it is a valuable asset that requires careful management. Beyond the joy of acquiring rare and interesting stamps, collectors can benefit greatly from adopting basic accounting practices.

Doing so allows them to maintain a precise inventory, track their financial investment, and document sales effectively. We will explain how collectors can use methods like those used in accounting software, to keep inventory, record prices paid, and track prices sold.

Building a Reliable Inventory System

A well-maintained inventory is the foundation of managing a stamp collection successfully. Without a proper system in place, it becomes easy to lose track of what you own, the condition of items, and where they are stored.

Start by documenting each stamp in an organized manner. Collectors should record details such as the country of issue, year, denomination, condition, catalog number (for example, Scott or Stanley Gibbons numbers), and quantity. For added clarity, it is useful to assign a storage location, such as an album name or page number, so that stamps can be quickly located when needed.

While some collectors prefer using notebooks or index cards, many opt for spreadsheets like Microsoft Excel or Google Sheets, which allow for easy sorting and updating. Specialized software like StampManage or EzStamp can streamline this process even further by offering catalog integration and photo attachments.

Tracking Prices Paid

Knowing how much was paid for each item in a collection is crucial for understanding its overall value. Tracking purchase prices allows collectors to calculate the total investment they have made and determine the financial performance of their collection over time.

When purchasing stamps, collectors should record the date of purchase, price, seller’s name, and source, whether it is an online marketplace, auction, or stamp dealer. It is important to account for additional costs such as shipping fees, taxes, or auction premiums, as these all contribute to the total acquisition cost.

Keeping original receipts, invoices, or digital confirmations alongside inventory records strengthens documentation and ensures that accurate records are maintained. Scanning paper receipts or taking photos can be an effective way to preserve this information for the long term.

Recording Prices When Selling

Recording sales is just as important as documenting purchases, especially for collectors who occasionally sell duplicate or upgraded items. Doing so not only helps calculate profits but also assists in tracking market trends and adjusting the collection’s overall value.

Each time a stamp is sold, collectors should record the date of sale, the buyer’s details, the sale price, and the selling platform used, whether that is a stamp show, online marketplace, or private transaction. Linking the sold item to its inventory record helps maintain an accurate overview and prevents discrepancies in the collection list.

It is also wise to keep track of selling expenses, such as listing fees, shipping, or seller commissions, as these reduce the net proceeds from each sale. Documenting these details helps create a clear financial picture of the collection’s performance over time.

Using Simple Accounting Principles

Incorporating basic accounting principles like cost tracking, profit and loss calculation, and expense categorization can make collection management more precise. Some collectors even set up simple income and expense statements to summarize annual activity related to their hobby.

For collectors with larger or investment-focused collections, a basic balance sheet can be helpful. This includes a list of assets (the collection’s estimated market value), liabilities (any loans or expenses), and equity (the collector’s own investment in the collection). While this level of tracking may not be necessary for every hobbyist, it becomes more valuable as the size or value of the collection increases.

Benefits of Organized Recordkeeping

Implementing these practices offers several key benefits. Collectors gain a clear understanding of the total investment made in their collection and can easily assess its current market value. This information is useful for insurance purposes, estate planning, and preparing for future sales or auctions.

Moreover, detailed records allow collectors to identify trends in the market, determine which types of stamps appreciate the most, and make more informed buying decisions. Organized accounting also reduces the risk of misplacing or undervaluing items, helping to preserve both financial and historical value.

Using accounting practices to manage a stamp collection elevates the hobby from simple enjoyment to thoughtful stewardship of valuable assets. By maintaining a thorough inventory, tracking prices paid, and recording prices sold, collectors can enhance the long-term value and enjoyment of their collections while creating a clear and organized record of their philatelic journey.

Leave a Reply